SBA Surety Bond Guarantee Program

SBA Surety Bond Guarantee Program

The U.S. Small Business Administration’s Surety Bond Guarantee program has helped small and emerging contractors who lack experience and financial strength to obtain bonds through regular commercial channels. The SBA guarantees bid bonds and payment and performance bonds issued by select surety companies, allowing contractors who otherwise would not meet their minimum standards to obtain bonds.

Old Republic Surety is pleased to partner with the SBA as a “Prior Approval” surety, providing bonds up to $10 million for federal projects and up to $6.5 million for any public or private contract or subcontract project.

SBG Program Is a Good Fit For:

- Start-ups & firms in business less than 3 years

- Firms with limited financial resources or job history

- Firms wishing to increase current bond limits

- Firms desiring to replace/reduce collateral

- Subcontractors interested in establishing capacity

Business Eligibility

- Construction, Service & Supply Firms

- $8 million revenue limit for some services such as landscaping

- $16.5 million limit for most specialty trades

- $39.5 million limit for heavy construction

- Ownership variables, good character & reasonable expectation of completion

- Contractor was unable to obtain bond elsewhere with reasonable terms

The type of financial information required is based on the size and style for the project. For those seeking smaller bonds for certain kinds of projects, the SBA QuickApp program offers easy qualification without providing any financial statements.

What are the benefits of the SBG Program?

It's an initiative established by the Small Business Administration to assist small and emerging contractors who may lack the financial strength or track record to obtain traditional bonds. Through this program, the SBA partners with approved surety companies like Old Republic Surety to provide a guarantee to sureties on eligible bonds, thereby reducing the risk and facilitating bonding for qualified contractors.

The benefits of participating in the SBG Program are numerous. Firstly, it enhances your competitiveness in the government contracting marketplace by enabling you to bid on projects that require bonds. This opens up a whole new realm of opportunities that were previously out of reach, allowing you to expand your business and increase your revenue potential.

Secondly, the program promotes growth and development by providing surety bonding support for contracts up to $10 million. This means you can take on larger projects and steadily build your portfolio, strengthening your reputation and credibility in the industry.

Moreover, the SBG Program encourages surety companies to work with small contractors by providing them with a guarantee backed by the federal government. This assurance instills confidence in sureties, making them more willing to underwrite bonds for small businesses. As a result, you can establish partnerships with reputable sureties like Old Republic Surety, benefiting from their expertise and industry connections.

Navigating the SBA Bond Program can seem daunting, but that's where we come in. At Old Republic Surety, we specialize in guiding contractors through the program, assisting them with the application process, and ensuring compliance with program requirements. Our team of knowledgeable professionals is dedicated to helping you understand the intricacies of the program and maximizing your chances of success.

Whether you're looking to secure bid bonds, performance bonds, payment bonds, or ancillary bonds, we have the expertise and resources to facilitate your bonding needs. With our extensive network of surety partners and our in-depth understanding of the SBG Program, we strive to provide tailored solutions that meet your specific requirements.

Don't let bonding limitations hold your business back. Take advantage of the SBA Bond Program today and unlock the doors to government contracting success. Contact us at Old Republic Surety to learn more about how we can assist you in navigating the program and obtaining the bonds you need to thrive in the industry. Trust us to be your reliable partner in achieving your contracting goals.

New to contract bonds? We have the answers to all your questions.

More from our blog:

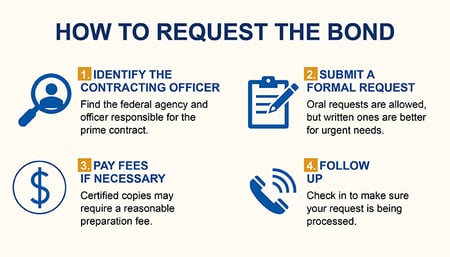

Getting Paid on Federal Projects: How Subcontractors Can Obtain Payment Bond Information

Why Young Professionals Should Consider a Career in Surety